Table of Content

Easy access to Village amenities as well as the City of Rutland, several ski areas and State Parks and Recreation areas. Located across from Wallingford Playfield, 5 brand new townhomes await. Designed to complement the existing aesthetic of the neighborhood, you’ll appreciate the cohesive streetscape that combines a classic exterior color pallet with warm cedar and stone wall accents. The varied floorplans include 2 and 3 bedroom layouts with contemporary finishes, LVP flooring, Bellmont Cabinets, high-end European appliances and Mitsubishi ductless mini-splits. With rooftop decks, designated bike storage, and dedicated off-street parking on most homes, don’t miss your chance to live mere blocks from this neighborhood’s vibrant shops and restaurants.

The home features two bedrooms, two baths, living room with dining room off to double sliders, large eat-in kitchen and bonus room in the front of the house for a family or recreational room. One bedroom and one bath conveniently located on the first floor. Detached one car garage with plenty of room for a workshop.

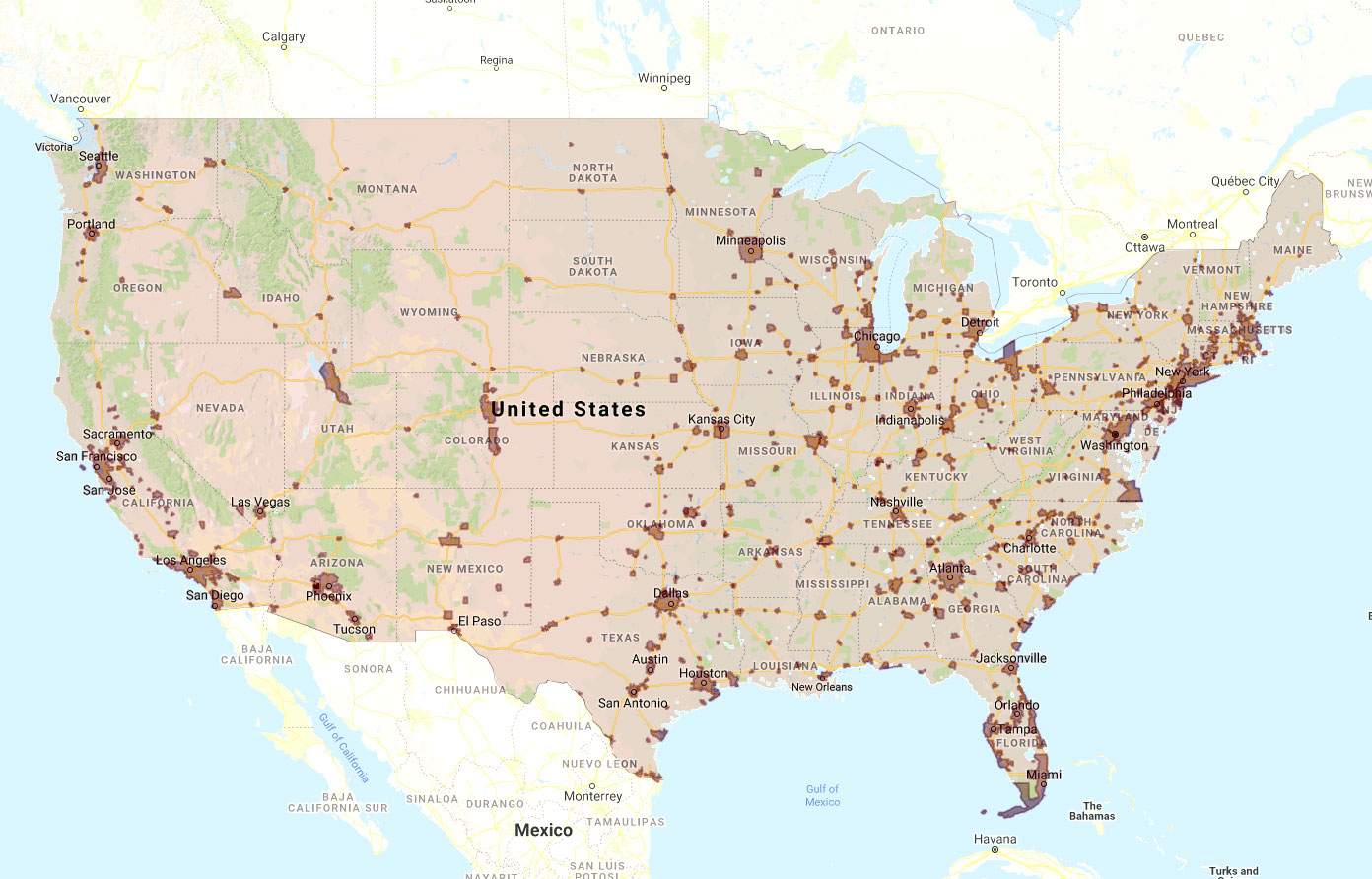

Wallingford Homes for Sale

Both units are being sold fully furnished, inclusive of all appliances and are currently vacant ready for the next tenants. This 1-acre corner, wooded lot sits just up the hill from Main Street with views of the Taconic Mountains. Luxury builder, Thomas James Homes, presents a charming pre-construction home in the heart of Wallingford.

Offering timeless curb appeal, 5 bed, 5.25 bath features ample room for all. Deluxe kitchen opens to great room and open concept dining. Flex spaces include game room opening up to rooftop deck with city views and enjoy beautiful sunsets. Convenient multi-gen suite on main floor, and secondary bedrooms with ensuite bathrooms on second floor. Spa-like grand suite w/ dual vanities + private deck! This home comes with a professional design package, the ability to customize+an industry-leading 10-yr new construction warranty.

Wallingford, CT Real Estate & Homes For Sale

This information is provided for general informational purposes only and should not be relied on in making any home-buying decisions. School information does not guarantee enrollment. Contact a local real estate professional or the school district for current information on schools. This information is not intended for use in determining a person's eligibility to attend a school or to use or benefit from other city, town or local services. `Ashfield` is one of a pair of substantial five bedroom semi detached houses built by Premier Developments. Situated within one of Wallingford`s most sought after roads and finished to the highest standard throughout.

This spacious home features an open plan kitchen, dining and family area with patio doors opening into the garden. This home comes with a garage and off-road parking. Stunning Wallingford home featuring updated appliances, cabinets, flooring and bathroom fixtures.

Wallingford real estate trends

No chain and ready for occupation immediately. This individual 1930`s detached property has been completley renovated by the current owners to offer over 2200 sq. Conveniently located within this sought after South Oxfordshire village. Set back from the road with a double garage and a generous south facing rear garden. The Solville includes a bay-fronted STUDY and dining room, an impressive kitchen/breakfast/family room with VELUX WNDOWS as well as FRENCH DOORS leading to the garden.

This display of listings may or may not be the entire Compilation from the NEREN database, and NEREN does not guarantee the accuracy of such information. Information is provided for consumers' personal, non-commercial use, and may not be used for any purpose other than the identification of potential properties for purchase. If you're looking to sell your home in the Wallingford area, our listing agents can help you get the best price. Save this search to get email alerts when listings hit the market. Each office is independently owned and operated.

Average home prices near Wallingford

Skylight, custom walk in closet and build-in cabinets and space saving side leaning murphy bed in the spare bedroom. Auxiliary 216 sq ft garage/carriage house in back. It has automatic garage door opening to a back alley to 53rd St. Ideal for possible future development as ADU. Coldwell Banker Realty can help you find Wallingford homes for sale and rentals.

Please check the school district website for more information. Coldwell Banker Realty and Guaranteed Rate Affinity, LLC share common ownership and because of this relationship the brokerage may receive a financial or other benefit. You are not required to use Guaranteed Rate Affinity, LLC as a condition of purchase or sale of any real estate. Operating in the state of New York as GR Affinity, LLC in lieu of the legal name Guaranteed Rate Affinity, LLC. You’ll get email updates when new properties matching this criteria go on the market.

Walk-in DRESSING ROOM to bedroom 1 and fitted wardrobes to bedroom 2 & 3. An imposing detached family home set in secluded grounds extending to 1⁄4 of an acre abutting farmland to the rear. The property is situated in this keenly sought after village with a its own local shop and pub and just over 3 miles to Wallingford and its amenities.

Find and compare apartments for rent in Wallingford. Listing information is from various brokers who participate in the Bright MLS IDX program and not all listings may be visible on the site. Some properties which appear for sale on the website may no longer be available because they are for instance, under contract, sold or are no longer being offered for sale.

With six-bedrooms, the property has a floor area of approximately 3370 sq ft and has been separated internally to create an Annex with a lift rising to the upper le... A characterful Grade II listed cottage with many period features dating back to early 17th Century with later additions. Sitting in a beautiful secluded 1/5 acre plot it features a gated driveway and parking for several cars. Located in the heart of this sought after village within walkin... A beautifully presented, extended home with gardens, garage and solar panels for electricity and water heating.

Small complex is made up of 3 separate buildings with courtyard/trees and privacy. Sited on the North end of Lake Union offering across the street access to Gas Works Park and The Burke Gilman Trail . The Fremont business district is a short distance away. Rarely does a South Facing of this size with views of the Lake and city become available for purchase. As one enters, you'll discover a formal entry hall that leads to a light filled floor plan with numerous vistas all around you. There is a gas fireplace, open kitchen, large deck a wonderful primary suite and a highly coveted den with city views.

Sold House Prices

Enjoy quintessential Seattle living upon the Haida Bird. A 555 sq foot work of art, this floating home offers waterfront living at its finest. Beautiful stained glass doors open to deck, and its position at the end of the dock allows for private nature living while living in the heart of the city. Take in the Seattle skyline while watching the water fowl pass you by. Freshly painted exterior and steel hull w/ ample storage in the hull.