Table of Content

The results provided by the Planner are generic in nature and do not necessarily reflect the actual investment profile that you may hold and it is not necessary for you to act on it. The Planner provides a generic indication of your money needs to enable you to prioritize your investment needs which are rule based. Therefore, the search results displayed by the Planner cannot be construed to be entirely accurate / comprehensive. You also acknowledge and agree that, unless specifically provided otherwise, these Terms of Use only apply to this Website and facilities provided on this Website. Other documents that you should keep handy include Bank account statements, CIBIL report, Duly filled loan application form affixed with passport size photographs of all the applicants/co-applicants.

These Terms of Use and any notices or other communications regarding the Facilities may be provided to you electronically, and you agree to receive communications from the Website in electronic form. Electronic communications may be posted on the Website and/or delivered to your registered email address, mobile phones etc either by Facilities Provider or ABC Companies with whom the services are availed. All communications in electronic format will be considered to be in "writing". Your consent to receive communications electronically is valid until you revoke your consent by notifying of your decision to do so.

Intrested in SBI Home Loans ?

We hope you enjoyed our article about home loans for construction. With this knowledge, we know that you can make the most of your next home project and do it fast with your own money. The period between the date on which you borrow the loan and complete the house construction is known as the pre-construction phase.

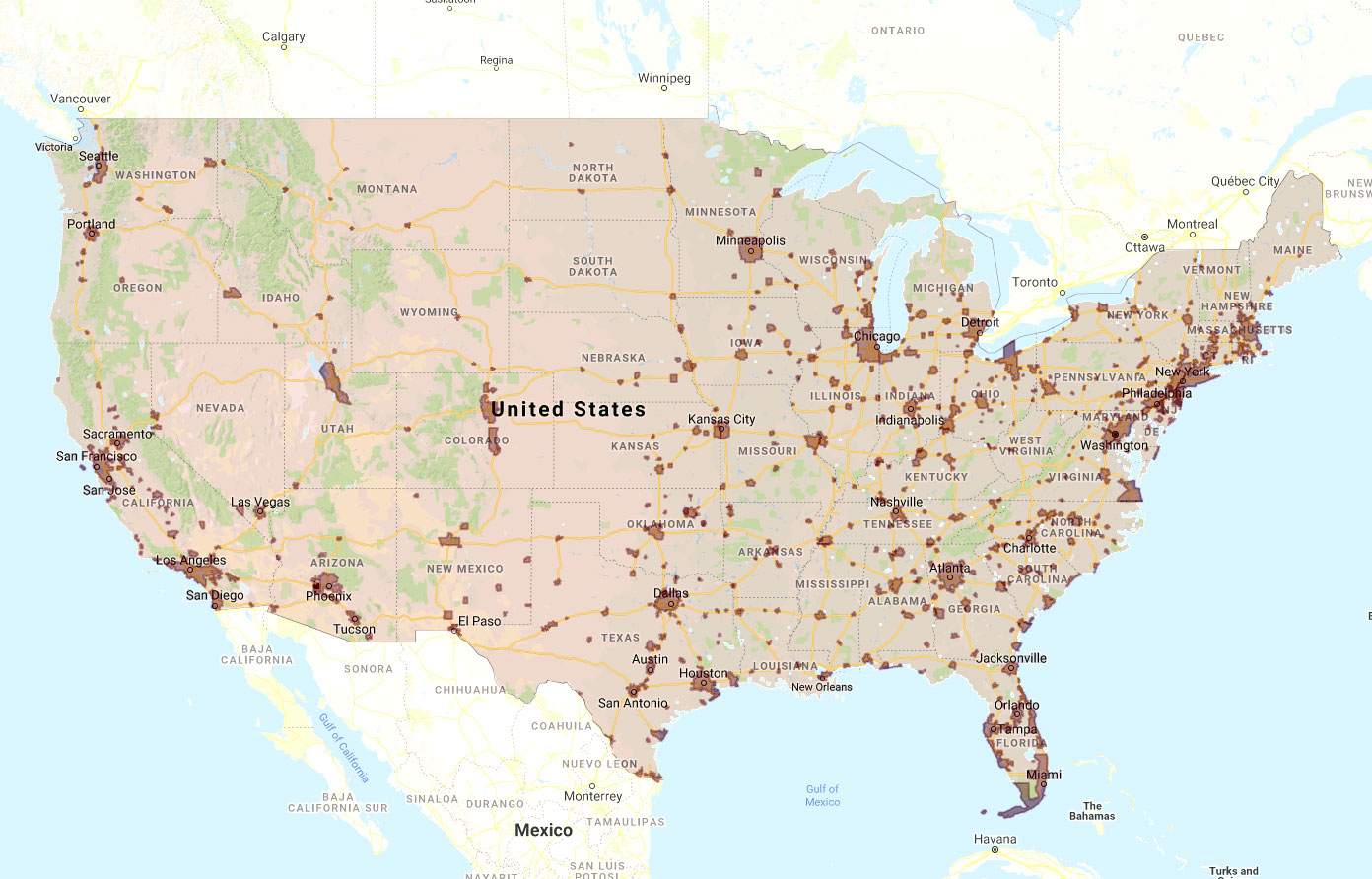

Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product. Aditya Birla Capital Group is not liable for any decision arising out of the use of this information. Mentioned below are some of the common home construction loan eligibility criteria for both salaried and self-employed individuals. World Class Post Disbursement and Customer Services – We offer an excellent pan-India branch network so that our customers are always within arm’s reach. We provide a dedicated team of experienced employees, state-of-the-art information systems and coverage for ultimate customer satisfaction – all tuned to the highest standards of ethics, integrity and transparency. With the PNB Housing Customer care portal & mobile app, customers can register themselves for a hassle-free online post disbursement service.

Company

We will begin by asking you several key questions, which will help us determine which mortgage products could work best for you. Refinance your existing home in Germany to lower interest rates or cash out on your home equity. I hereby authorize State Bank of India/ its group companies and/or their representatives to contact me via calls, mails and/or text messages on the contact details so provided to offer me the product offerings of SBI/Its group companies. SBI welcomes you to explore the world of premier banking in India. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI.

Life Insurance Corporation of India is one of India’s oldest and largest insurance companies. LIC is a government-owned company, and it enjoys certain advantages over private life insurance companies. Established in 1989, LIC Housing Finance Limited is a subsidiary of LIC. Two-closing construction-to-permanent mortgages must follow standard limited cash-out and cash-out refinance limits for loan to value , combined loan-to-value , and high combined loan to value ratios.

Loan Schemes & Articles

The interest rate for loan applicants seeking loans for home building depends on a number of variables, including their credit score, monthly income, employment history, and loan amount. The interest rates offered for normal home loans and loans for home building are often the same. HDFC bank is a private Indian banking and financial services company headquartered in Mumbai, Maharashtra. The bank has a strong network of branches and ATMs across the country and provides a wide range of digital banking services.

“Simply put, my wife and I would not have our dream home without the help of LoanLink and Başar. Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. Your personal mortgage expert will support you to review and understand all your options. We'll calculate your maximum property budget based on your income, savings, residency status and the criteria of our 750+ partner banks.

✅ Can I Buy Land with a Home Loan?

Until you fully repay the borrowed amount, you are permitted to use this deduction once every fiscal year. Closing expenses for this type of loan will be higher due to two loan settlements. However, since you will secure a loan with mortgage refinance rates, it will be more affordable than the rates provided in one-time-close loans. With two-time-close loans, you will acquire a better rate on the permanent mortgage.

We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot. The results of the mortgage calculator give you a first impression of your mortgage possibilities and help you to get orientated. It is a sample calculation that shows an overview of your expected costs. However, our calculator does not replace a personal consultation.

ABCL is an independent entity and such information from any ABCL Affiliate are not in any manner intended or to be construed as being endorsed by ABCL or Facilities Provider. The information does not constitute investment or financial advice or advice to buy or sell, or to endorse or solicitation to buy or sell any securities or other financial instrument for any reason whatsoever. Nothing on the Website or information is intended to constitute legal, tax or investment advice, or an opinion regarding the appropriateness of any investment or a solicitation of any type. You are therefore advised to obtain your own applicable legal, accounting, tax or other professional advice or facilities before taking or considering an investment or financial decision. All Personal Information including Sensitive Personal Information provided/related to you, shall be stored/used/processed/transmitted expressly for the Purpose or facilities indicated thereon at the time of collection and in accordance with the Privacy Policy. Other than those otherwise indicated and agreed by You, this Website do not collect or store or share your Personal Information.

This helps you save money on utility bills and make your appreciate your home value. If you’re considering a home construction loan, seek and compare the interest rates and terms from different lenders. You can also talk to a financial advisor to get more information about home construction loans. To find the right mortgage, there are some points you should consider. For example, it is advisable to plan the mortgage, so you have paid it off by the time you retire. Also, keep in mind that you usually need to pay the additional purchase costs yourself.

A construction-to-permanent loan, also known as a C2P, may also be an option to the borrower. The borrower pays interest only and only on the amount drawn each month. These funds are used to pay for the work performed by the subcontractors and the materials that were used.

The bank offers personal banking services like loans, credit cards and other financial products to individual customers. It also provides wealth management solutions through its subsidiaries – HDFC ERGO Insurance Company Limited , which is a joint venture between HDFC Ltd. Home construction loans are available through banks and financial institutions, including credit unions and payday lenders.

Salaried Individuals

An FHA one-time construction loan is a type of home loan that's backed by the Federal Housing Administration . FHA loans are designed to help moderate-income borrowers with below-average credit scores buy homes. Typically, the bank would include a 5% to 10% contingency sum to account for cost overruns, which are too common on house construction projects. You can consider these house construction loans as a handy line of credit which can be easily used if and when needed.

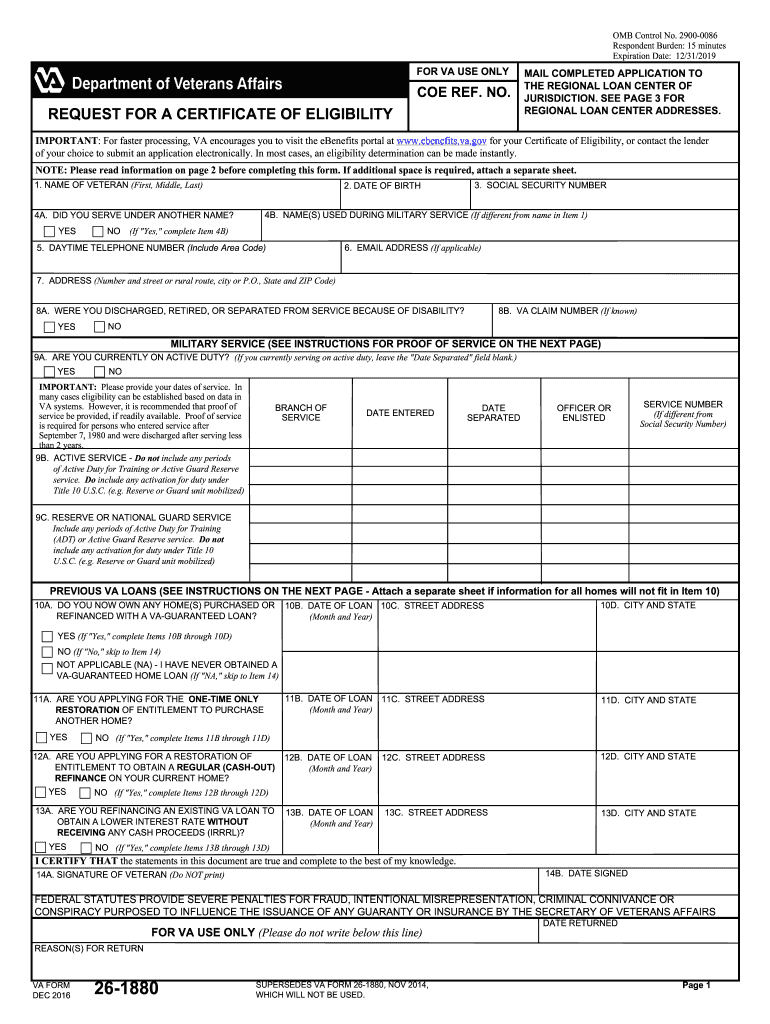

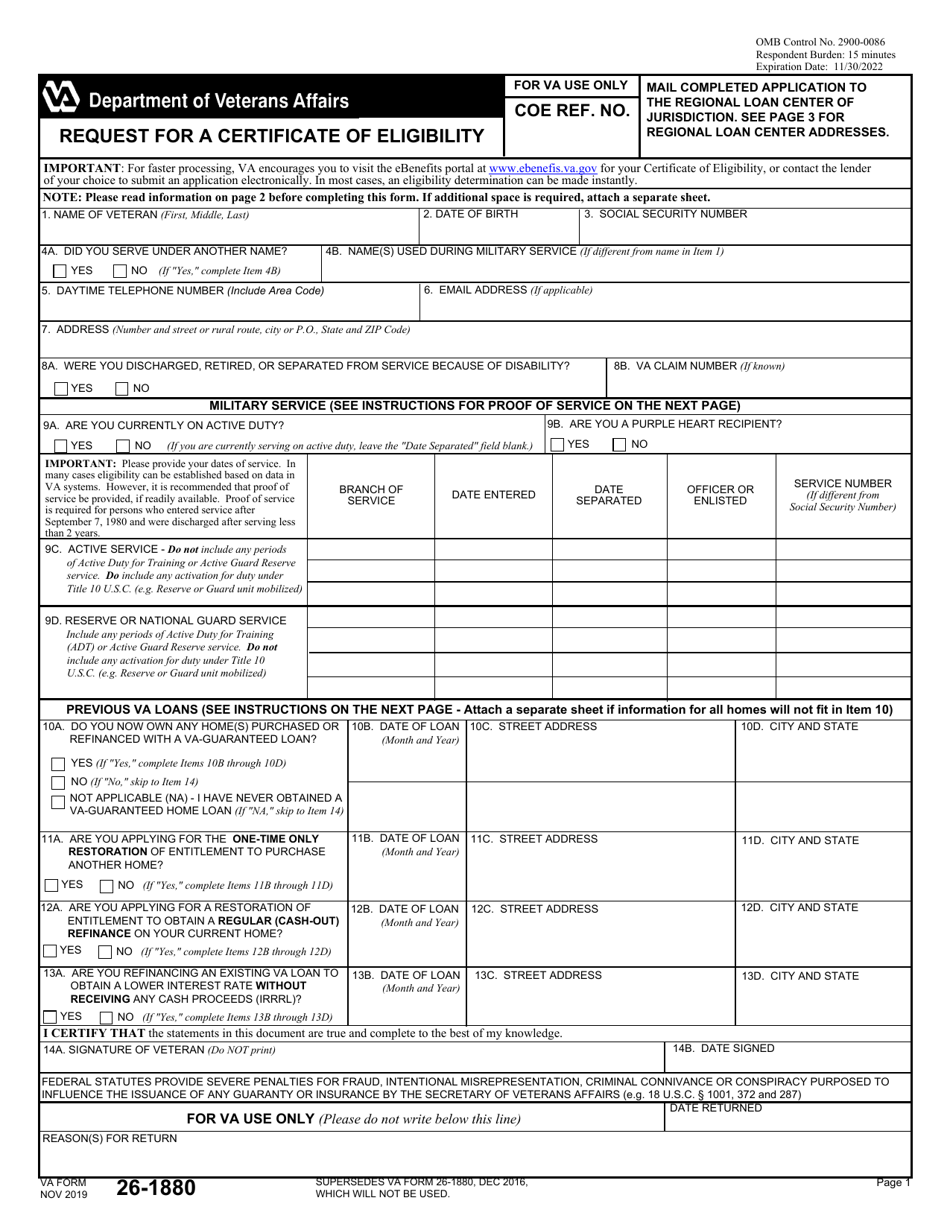

Although not a complete list, the following documents must be submitted by the borrower with the loan application in order to be considered for a home construction loan. Banks and HFCs often approve loan applications for home development from borrowers who are at least 18 years old. Most banks and HFCs mandate that borrowers of home building loans finish paying back their debt by the time they turn 70.

No comments:

Post a Comment